In this article we’ll discuss how you can make money in a Bear Market. We’ll cover how to invest in Bearish Markets and look at some Bear Market investing strategies.

NOTE: Options trading can be extremely risky. Everything mentioned in this article is for education purposes only. Do not invest in any security without the help from a professional.

What Is a Bear Market?

Bear Markets are when the overall market experiences prolonged price declines. Typically they are represented by a 20% or more decline over a sustained period and is often associated with an economic downturn or recession. A Bear Market can last as little as two or three months, as in 2020, or as long as several years, like the 2007 – 2009 crash.

In many cases, you will see volume begin to mount as institutional investors begin selling off their positions. The sell off can last as little as a month or as long as 12 months as we saw in 2007.

As volume and selling picks up, there is typically significant negativity and pessimism in the market place as well as the economy. Panic begins to set in and you see the volatility index of the market begin to rise sharply.

Sadly, by the time the market sees some of its worst losses, retail investors begin to cash out, often near the bottom. The pain of seeing their portfolios losing 40%-60% is too much to cope and so they often sell and lock in those losses.

Bear Market Investing Strategies

To be able to make money in a bear market, you need to be able to capitalize on all the panic going on around you. While there are several investing strategies for bear markets, my favorite investing strategy is buying stock options.

Stock options are contracts that give the owner rights to buy or sell shares of stock on or before a given date. In short, you are able to sell or buy a stock you don’t even own.

One investing strategy in a bear market is buying Put Options. A Put option is a stock options contract that gives you the right to sell a specific stock or ETF at a specified price on or before the expiration date.

For example, let’s look at a favorite company, Apple (ticker symbol AAPL). Suppose you felt the stock price of AAPL was going to crash. On March 29th, 2022 you bought a 17JUN22 180 Put for $930. This contract gives you the right to sell AAPL on or before 17 June for $180.

As it turns out, you were correct and AAPL began crashing in price on March 30th. On June 1st, 17 days before your contract expires, AAPL is trading at $148.

Because of this, your Put contract is now worth $3,137 or a 241% return on your investment (ROI).

Protecting Your Investments In Bear Markets

Looking at the example above also gives you insight into how you can protect your investments in bear markets as well. Think of that Put option as Insurance.

An important point of an option contract is that it represents 100 shares of the underlying security it represents. In our example above, your 17JUN22 180 Put represents 100 shares of AAPL stock.

Using that same transaction let’s assume you are the owner of the AAPL shares. On March 29th, you purchase 100 shares of AAPL at $180 purchase the same Put option above.

The AAPL shares you purchased are now insured with this Put option at $180, just like insuring your car. No matter how far AAPL drops, your max loss is the cost of the Put option, in this case $930.

How Can I Protect My 401K

As great as stock options are for both investing in Bear Markets and protecting a stock investment, things become a little more involved when protecting an investment account such as a 401K.

Most if not all 401k’s don’t allow you to buy or sell options contracts in them. So how can you protect them during a Bear Market?

While this is not a quick and easy answer, it is possible.

You’re Going To Need A Broker Account

To be able to do this, you will need to have a separate “margin” account with a broker and you will need to fund that account in unison with your 401K.

As an example, suppose we have a 401K with a balance of $100,000 and we also have a separate brokerage account with $20,000.

We would then be able to purchase the Put options in this margin account to insure the 401K account.

If the market crashes down and a bear market is triggered, as your 401K balance is reduced by the crash, the margin account will increase in value. And while you may not actually make money, you will lose less of your net worth.

How To Make Money In A Bear Market

A very important aspect many investors cannot comprehend or adjust to is how we make money in a bear market. Most are looking for ways to actually generate a profit as I gave in our first example.

However, making money and profiting in a bear market is extremely difficult. This has a lot to do with the severity and volatility of a bear market.

With bull markets, prices tend to increase at a gradual pace with small corrections and pullbacks along the way. These small pullbacks generally only last for a short period of time before the market continues its upward trend. Because of this, volatility is typically low and we don’t see huge swings in prices during this time.

Bear Markets Are A Much Different Animal

A bear market is a much different animal. Bear markets often see huge price changes each day, week and month. It is not unusual to see the price of a stock or ETF change by as much as 5%-6% in a day.

This can present a significant challenge when trading bear market strategies, such as the Put option. Options are highly leveraged contracts as they represent 100 shares of the underlying security. When the security moves $1, the option can move as much as $100-$500.

In a bear market, it’s not unusual to see your Put option at a 70% profit one day and a 10% profit the next. This makes exit strategies extremely difficult.

To help you understand this challenge, it’s important to change the way you look at “making money” when you are trading in a bear market.

Investing Goals Are Critical

The goal of every investor, whether they are a seasoned professional or retail investors like us is to beat the overall market year to year.

Using this premise, the goal in a bear market is to lose less money than the market. So as the investor, you need to change the psychological make up you have with regard to “making money” in a bear market.

The goal therefore isn’t to make money, it’s to lose less than the market is losing.

To illustrate this point, how would you feel if the market fell 45% from it’s all time high, but your account only fell 10%?

Most of your friends and family would pay you to show them how you did it.

When you employ options correctly to protect your overall investment account(s), that is exactly what you can achieve.

Back To Protecting Your 401K

Let’s get back to our 401K example. In this example we have around $20,000 in a separate investment account. We will use the bear market of 2007-2009 in our example.

In October 2007 we buy Puts on SPY to act as insurance for our 401K.

No one is really aware, but the upcoming pull back is going to be what turns out to be the beginning of a severe multi-year bear market.

Looking at this short three month chart above looks like your ordinary pull back in a bull market. Nothing too concerning and many of the short term indicators don’t have folks too worried.

However, as we will see, things slowly get worse. The economy is crashing down due to the overheated real estate market. What follows is 18 long months of pain and anguish and a market that suffers a 57% decline.

Looking at the chart above, the markets initial decline doesn’t look too alarming. The market suffers some losses, and then looks as if it is going resume its upward trend. Up until 2008, where it begins to crash down.

What started as what appeared to be a normal pull back lasted 17 months before it hit bottom on March 9th, 2009 where a new Bull market started taking shape.

Having a $100K account, we see it erode to approximately $43,000, losing roughly $57,000.

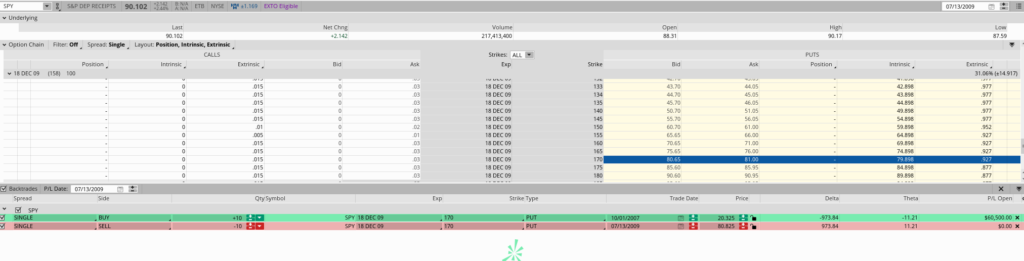

Let’s overlay our insurance during this same time frame. With our roughly $20,000 margin account, we purchased 10 18DEC09 170 Put contracts. The cost of this transaction was approximately $20,320.

As the market crashed and and your 401K gets decimated, your Puts grow significantly in value.

For demonstration purposes, I didn’t take the value of those Puts on the day the market bottomed because we would not have known this. Instead I chose a time frame based on tools available that would have told me when to sell them.

On July 13th, 2009, we sell those 10 Put contracts and generate a $60,000 profit (See below).

While your 401K balance was reduced to around $43,000, your margin account is now worth $80,820. When we started we had a total of $120,000 between our 401K and our margin account. When everything is all said and done, we are left with roughly the same.

So, while everyone else lost 57% of their net worth, you lost nothing. The average 401K holder would be starting the new Bull market in 2009 with $43,000 and you would be starting with the same $120,000.

As this example shows, we didn’t make any money during the bear market, but most importantly we didn’t lose any.

Keep Bear Markets in Perspective

While I just showed you a hypothetical example of real numbers, it’s very important to keep bear markets in perspective. What do I mean by this?

First, I would highly suggest you stop watching and reading the news. Follow programs or leaders in the industry that are giving you positive outlooks, not news stations and papers or forums that make money from others fear and panic.

Second, bear markets don’t last forever. And while we can’t tell how long they will last, it’s important to have a game plan and stick to it. Even if you are just planning in the middle of a bear market, use sound financials and reasoning and avoid your gut feeling.

In 9 plus years of investing and managing my own retirement account, my gut feeling has not avoided the worst of the market. Emotions and that gut feeling often compounded my losses.

Third, and probably most important, stay patient. Don’t rush into any investment advice or hot tips. Even this article should not be promoting you to go out and buy a bunch of Puts on SPY. You would most likely lose all your money.

Bear markets can be unpredictable and volatile. They are also great opportunities to increase your net worth. In reality, money isn’t made in the bear market. It is made in the subsequent bull market.

Patience and a solid plan will dictate your actions and when to pounce. A very wise saying by one of the greatest investors in our time, “Be greedy when others are fearful and be fearful when others are greedy”. ~ Warren Buffett.

Resist The Urge To Just Jump In

I provided you with a hypothetical scenario using actual values. So while it was hypothetical, it was also a scenario that was used by my mentor who was able to produce similar results.

Therefore, resist that urge to go out and open a margin account and invest in SPY Puts. If you know nothing about options, this will surly lose all your money.

Options trading is risky for those that know nothing about options. I’m able to do this because I’ve learned how to use and trade options.

Also, there is a time when it may be too late to get out of a bear market. Your 401K balance may be down 25%, but this is a paper loss. If you exit during the bear market, you just booked those paper losses.

It’s Hard To Plan For A Fire In The Middle Of A Fire

As this may seem obvious, many will dismiss this most important paragraph. They are excited by the example I showed above and will run out and try and implement it.

This will most likely have disastrous results. This is why I stated at the very beginning of this article that it was crucial to read the entire article and not skip around or try and implement any strategy discussed.

Being prepared takes planning, and planning takes knowledge. Even if you are not knowledgeable in options, you can still put a plan together to protect some of your assets during a bear market.

And while I can’t go into great detail here as to how you can do this, I’ve now given you some tools and resources that can help you prepare for the future, even if you do end up suffering a massive loss if this turns out to be a multi-year bear market.

What Should I Do Next

After reading this, many may be somewhat overwhelmed or even confused and you are asking yourself, “what should I do next”.

I would suggest you start where I started, but with some time saving steps.

I began the very quest you may be searching for now back in 2012. I just suffered through the Bear Market of 2007-2009 and watched my account be reduced by over 60% (Even though the S&P fell 57%).

It took another 4 years before my account got back to break even with contributions. At this point, I realized I would not reach my goal in the time frame I planned for.

Plug Into A System

So while I read a ton of information and watched a bunch of videos on YouTube, it wasn’t until I plugged into a system and group that I started to see some real positive results.

It didn’t take long before I was hooked on options, but also on books and material that have changed the way I think today. I no longer look to hit home runs or try and get rich quick. I am slowly and patiently building my net worth while at the same time improving our financial picture.

I’ve provided some links below to get your started. All the links provided are either affiliate links or paid programs I teach or have taken.

10 Years Of Research

I found in my last 10 years of research that if you want to see results that are not only effective but duplicatable year after year, it is through paid programs with proven templates.

Whether it’s stock investing, real estate investing, affiliate marketing, health programs, etc., I have always found that paid programs with proven blueprints help me achieve my goals the quickest and most effective way possible.

This is not to say it can’t work through free programs and free video lessons. However, it is often difficult because you are left to figuring out all the different pieces of the puzzle.

Buy Into A Proven System

Buying into a proven system will most likely be your most expensive option. However, it will also provide you with years of experience that works. I’ve found that time is my most valuable asset, so plugging into a system that shortens the learning curve and provides results quicker works best.

Starting With A Lower End Course

Buying into lower end courses are typically geared toward one investing strategy. While not free, this is still relatively inexpensive and can provide you with very good information and develop your investing skill set. Many of these programs do have additional “graduate” courses as well.

The last is to invest in high end courses that have proven results. This is going to be your most expensive option and you still need to do a little research to determine which are the best value for the money. Word of mouth from someone you know or trust is often your best avenue, but it can still be a challenge.

All the programs I recommend are programs I have already personally implemented a validated. I also have provided a link to my own course that I’ve co-founded with my mentor who taught me everything I know about investing, wealth, money management and options trading. I’ve left all the links below, but you can also find them at JPCashflow.com

Links

MarketClub Options Bootcamp – This is a free options basics bootcamp taught by my mentor and the 2019 US Options Investing Champion. This is the same program I learned when I first came across options.

MarketClub Options Lifetime – This is a limited time program, so this may not be available when you click the link depending on when you are reading this article. The MarketClub Options program is the first paid program I joined that taught me how to turn a $5K account in $45K in just two year. Normally this course is $450 for one years access to both the Options training program and MarketClub. However, this special offer will give you lifetime access to both MarketClub and the Options training program for an unbelievable price.

MarketClub – If you are already a stock trader, MarketClub will provide you with the best software I found available. MarketClub provides trade triangles along with a host of other useful tools for the investor. Their proprietary software provides you with entry and exit signals and scores for all of the stocks traded in the US and some European and Asian Markets.

Learn Stock Options Trading – This is the course that started the Options Basics Bootcamp in MarketClub. This is a totally free course that you learn at your own pace through training modules. Although it doesn’t provide any video material, it is the best way to be able to build your options knowledge base for absolutely free.

Options Wealth Academy – This is the program I co-founded with my mentor. This is a flagship program that teaches two powerful strategies I used in 2020 and 2021 to grow my small trading account by over 800%. Currently, as of 2022, we are offering a special price for our inaugural launch this year at over 70% off. However this is offered to the first 100 students in 2022 and won’t last long.

“It’s Hard To Plan For A Fire In The Middle Of A Fire”… a lot of truth in that! Great article Peter.