If you haven’t begun to formulate a plan for the next market crash, you may already be too late!

Most headlines start out this way and put fear into your head as if they have the answer or are even going to give you some type of answer to the headline.

I am not going to do that in this article. Although the first line does have some truth to it, I will show you how I overcame that fear.

Over the last 7 years, I have been working on increasing my knowledge and skills to learn more about financial management and investing and prepare for the next market crash.

During this journey I have been learning how to handle the next market crash, yet I still feel a little unprepared for the next one.

Regardless of this feeling, I will still continue to prepare my investment accounts.

Our society seems to live by something I call the “zero to 60” mentality.

People are either doing 60mph or they are at a standstill. There is no in between.

You can see this when there is a tragic event. I experience this in the Air Force all the time.

When something goes wrong, we stop what we are doing and immediately start down a different path, never actually evaluating the path we are on.

Successful and wealthy people don’t look at life that way.

In our Success Academy live calls, Travis is almost always asked what he is investing in or what trades he is working on.

What I have learned under Travis’ mentorship is that I need to be able to answer those questions for myself and not worry or compare myself to what others are doing.

Let’s take 401k’s for example. I don’t believe my 401k will be our sole source for retirement. I don’t base this on a theory, I base this on my actual 401k numbers.

Most believe that you need to invest the maximum amount into your 401k so that you will be able to live off the balance. Obviously, you need a compounded return for that balance to grow.

That may have worked in the 80’s and 90’s, but I don’t believe it works anymore.

Let me show you what I mean.

First, if you have a traditional 401k, understand that the ultimate balance you achieve will be reduced when the IRS gets their cut. This is a fact and there is no debate, you have to pay the taxes on that money.

Secondly, buy and hold worked in the 80’s and 90’s, but it doesn’t work as well today. Let me illustrate what I mean.

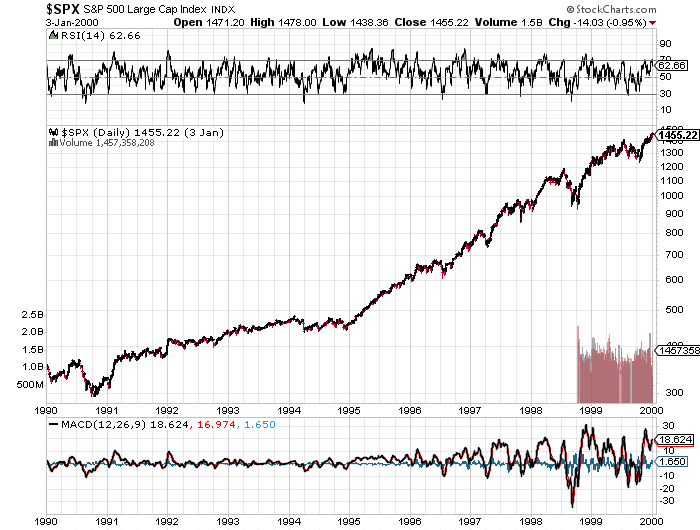

Below is a chart of the S&P500 from 1990 – 2000. As a buy and hold investor (which is how most 401ks are set up) I did very well. Looking at the chart you can see there are no major market crashes.

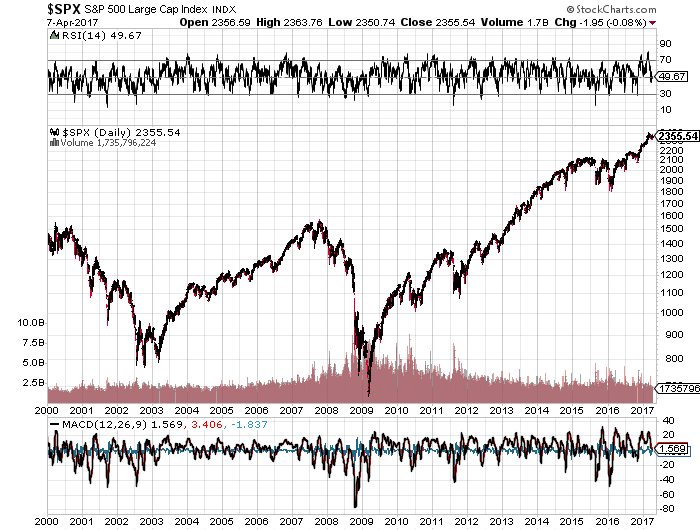

Now, contrast that with today’s market. Below is a snapshot of the S&P500 from 2000 to today.

You can see a huge difference between the two. As a matter of fact, if I started investing in 2000, I didn’t realize a profit until 2013.

On the chart you can see market crashes or pullbacks. These crashes and pullbacks reduced my account value.

More importantly, they reduced my investing time. From the Market Crash of 2007, you can see on the chart that it took four years just to get back to break even.

I look at these numbers and realize that buy and hold is out dated.

Personally, my account has seen two market crashes, 2001 and 2007. And my balance is a testament of the death of buy and hold as I started investing in my 401k in 1993.

Even today, most of us are taught to “Buy and Hold”. Some 401k’s have a Target Date Fund option , but this may not help.

Target Date Funds are funds where the money manager of your 401k invests in specific growth funds based on your retirement date you pick. (For Federal Employees this is called Life Cycle Funds)

Here is the problem; The top 20 TDF’s performance average in 2008 was -27% return[1].

And these were funds based on a 2010 retirement date. So when the fund should have shifted most of the focus from aggressive growth as the account neared retirement, the majority did not.

Imagine if you were just about to retire in two years and your balance was reduced by 27%? That’s before taxes.

The resulting market crash forced people to work longer as they no longer had the balance they needed to retire.

It forced me to find a different path as I am not willing to work for the government until I’m 65.

So, if you are thinking you are safe because you have a TDF where the professionals are managing the performance of your account, you may want to do some more research.

Now For The Good News

So, does all of this mean I don’t take part in any 401ks? Of course not. Most 401ks have a matching feature and that is free money.

The difference is now I actively manage my 401k. For example, my current position in my 401k is a similar position to cash. My returns are minimal. (Most tell me I’m stupid and losing out on returns)

More importantly though, I don’t lose money during a market crash.

I do this because the market is making all time new highs and if I am investing in it, I am buying expensive stuff that inevitably is going to go on sale.

The first and most important concept of investing is to learn how to “Not Lose Money”. I put that in bold as it is my number one investing principle.

I invest this way because I learned a valuable lesson called Power contributions and it is how Warren Buffet invests. I learned this in the Success Academy.

Our 401ks will be the financial vehicle that creates wealth for us.

The first thing you need to start doing is thinking long term. Wealth is not created in a short span.

I don’t believe buying and holding stocks, ETFs, even Real Estate in the hopes it will be worth more when you sell is a viable plan.

For some, this has worked in the past. But, most successful investors don’t make that their focus.

Many investors, even in Real Estate do not buy a property in the hopes it goes up in value. They buy the property at a discount and as a cash flow resource that they can one day leverage for a better property.

And most don’t hold their properties longer than 10 years, unless it is a cash cow. Their investment is constantly bringing in monthly income.

Trading in the Market is no different. Before you just go out and buy a company’s stock, you must have a game plan for that stock.

If that game plan consists of you buying it and one day selling it for higher in the future, well then now would be the wrong time to buy because most big companies are hitting all-time highs.

Side Note: If you are an IBD subscriber, this is contrary to what they teach. However, there is more to that strategy than just buying when a company hits all time new highs.

The other problem with this strategy is that you have very little control with the stock’s performance. You have to sit and hope it goes up.

Here is how my strategy with my 401k is different. As a matter of fact, it is different for all my investing accounts.

First, I do not need a $1million balance.

I only need a balance of $100k. This is a much more achievable goal.

Next, I need to be able to earn income from that balance.

I do this trading options and my favorite and most successful strategy is called a Vertical Credit Spread.

I am able to earn 2-5% of monthly cash flow. Currently, I use this strategy on one of our small IRA accounts.

My goal is to earn a minimum of 2% each month. If I achieve that goal, that is a return of 24% for the year.

24% of $100k is $24,000. If I earn 5% that’s 60% per year. This is a strategy that works no matter what the market is doing.

As a side note, I will actually make more money during the next Market Crash!

By achieving this goal, I will make $24k per year and best case is $60k per year. And if I have a $200,000 balance, my income increases.

Can you see why I don’t need a huge balance in my 401k? If you couple that with the fact that we have very little debt, we can live the same lifestyle we are currently living.

The main difference is I don’t have to go into the office for 9-10 hours a day.

So what can you do today?

The best way to assess your investment accounts is during a market crash. If your account loses more than 30%, you need to reevaluate your positions, unless you can withstand this type of loss.

The key is to assess them before the market crash occurs.

If you aren’t sure, there are steps you can take now that will help you through the next market crash. Even if you aren’t positioned to make money on the next crash, that’s ok.

You need to be positioned so you don’t lose money on the next crash.

The first step I took was getting out of debt. There are several tools available to help you achieve this goal.

My wife and I do have some debt, but compared to our financial balance sheet it is minimal and a job loss would not affect us. It would only affect future anticipated investments and expenses.

Next, do research on your 401k. A good place to start is America’s Best 401k.

My second step was learning about Power Contributions and when to get in and out of the market.

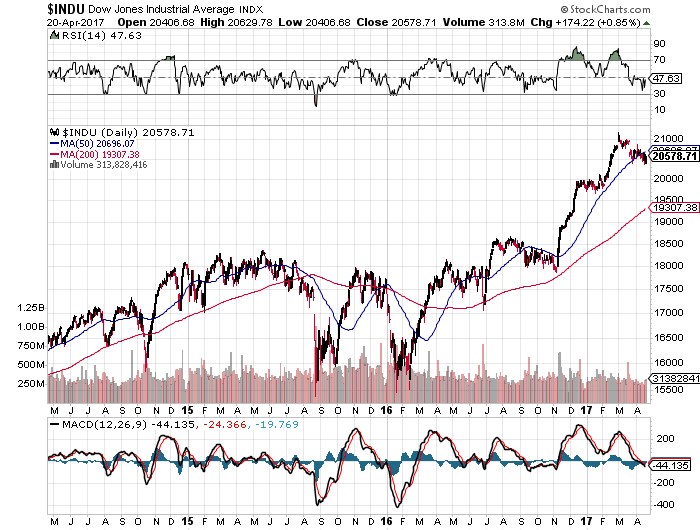

Therefore, when the market looked as if it was crashing in the summer of 2015, I sold all my aggressive growth positions. You can see that in the chart below.

I do this so that I have a significant amount of cash to buy in when the bottom hits and the market rebounds. This is called Power Contributions.

The market eventually rebounded in early 2016 and continued to go up. And based on what it is doing today, I am out of aggressive growth funds.

I invested in my financial education to be able to determine when to get into and out of the market.

Start with a low cost option like the IBD (investors.com). They will teach you how to do this. There is a wealth of information on investing.

Another investing tool I use is MarketClub. The link below will give you a free trial with no commitments.

I encourage you to check it out.

If you want to do what I do, invest in an options course. My favorite is Travis’ course. Go to www.learn-stock-options-trading.com. There is a wealth of “Free” information to get you started.

The true wealth is created in the Success Academy and that site will give you more information to that.

You can also go on Amazon and get John Masland’s book on Income strategies like the one I described above called Stock Market Insurance Trader.

So that’s it, in a nutshell. These are the first steps for you to take control of your future.

Don’t worry, you don’t have to do all this in a week or even a year. It’s good to write out your plan that covers the next two years.

For some, two years is what it will take to get out of debt and that is a great first start. As a matter of fact, if you are looking to invest money while you are in debt, that is a zero sum game.

Here is why:

If you have credit card debt, that debt’s interest rate is most likely over 25%. So, if you have a total balance of $10,000 or more in credit card debt and you were earning 2-5% per month on a $10,000 trading account, you would never dig yourself out of that hole.

You need to get out of debt first.

You will also need a team. You need coaches and like minded people around you all the time.

Listen to the doers, not the naysayers. Invest in your education and find a mentor.

So to recap:

- Get out of Debt

- Learn how to Not Lose Money.

- Learn how your 401k works and learn how to book profits.

- Increase your financial knowledge that teaches you how to create monthly income from your money.

- Write in and share your story.

- Enjoy Life!

- Give Back!

A very important note! I am not a financial advisor and I am not giving you financial advice. Please do not just read this article and make changes to your investment accounts. You must increase your financial education first!

Great article, I wonder how many people will actually heed your advice!

Based on the averages, there would need to be at least 100 people to read the information for one person to actually take action. Of course I just made that statistic up, however, the average American between the ages of 55 and 64 have accrued $104,000 for retirement. So, if you don’t follow any of my advice, and you are banking on your 401k to be your income in retirement, you are in for a bumpy ride and you will have to work after you retire. I hope people listen and at least increase their knowledge so they don’t realize at age 65 they are in trouble.