Lately, I’ve been seeing more courses on how to make money trading options using high probability options trading strategies.

This article will show the inherent risks associated with high probability options trading strategies.

What is a High Probability option trade?

For starters, let me just give you a quick synopsis of what a high probability options trade is.

A high probability options trading strategy is one that uses out-of-the-money options.

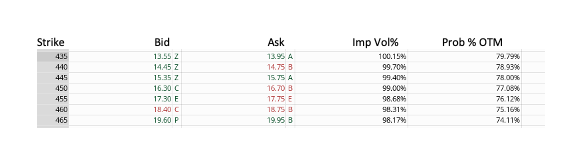

In many cases, the broker platform you use to trade options will have a probability indicator. This indicator will show the percentage of probability that a specific option contract will expire OTM. Below is an example of TSLA and the probabilities for the different option strikes.

As you can see, the farther up we go, the better the odds. It shows that buying or selling the 465 Put option on TSLA has a 74.11% chance of expiring OTM. As you go up the chain, the probability increases.

This is how options sellers justify the risk they are going to take on this trade.

For example, if I were to sell the $465 Put option above, you would generate a credit of $1,960. If the option contract expires worthless, with a 75% chance of doing so, you will keep that $1,960.

That’s pretty darn good for a quick five minutes work. If I do this each month, I stand to generate $23,520 (less commissions + taxes) per year on this one strategy.

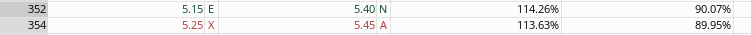

Want even better odds and generate the same income? Take a look at the image below:

This chart shows our income has been reduced to just $540, which is still pretty darn good. In order to make up the difference, we sell either 3 or 4 contracts. This will generate $1,620 or $2,160 in revenue respectively.

The main difference is now we have increased our odds to 90.7%.

Given those probabilities, you could have approximately 11 months of winning trades and just one month of a losing trade.

You will have generated $23,760 on 11 of your trades and lost perhaps $2,160 on 1 trade. This is based on always selling a Put with 30 days life and a 90% chance probability. The option expires worthless and you keep the credit.

And that my friends is the basis of a high probability trade. Sell your options OTM with a high probability of expiring worthless and you can generate a great return.

Don’t Jump On Your Platform Yet!

Does this sound too good to be true? Are you a bit skeptical? If not, carry on and I wish you the best of luck.

For everyone else, let me walk you through your risks and the reality of probabilities.

Let’s start with the first example. By selling that Put, you are obligated to buy 100 shares of TSLA stock at $495

In the second example, you sold 4 contracts or $140,800.

So, there’s your risk. And to calculate the return, simply divide the revenue by your risk. In the first example, the ROI would be 1% and .25% respectively

These aren’t bad returns. As a matter of fact, in the first example you could make an 11% annual return, beating the market average.

But, don’t congratulate yourself yet. There is a real down side that I have yet to share.

To begin with, this is a theory-based strategy on the fact that your probabilities will pretty much hold true. These probabilities are only as good as the information known at the time.

And as we’ve seen so many times, many of the experts are flat out wrong. The fact is that probabilities are just that. This “probably” won’t happen. There is no guarantee and those probabilities can change in 24 hours.

It’s incumbent on you to weigh the odds and see if the probability is worth the risk.

There really are some big risks with these high probability options strategies.

Most importantly, the probabilities often change with new data, price move, volatility, and so forth. Many of these changes can be predicted, but oftentimes there is something that can’t be predicted.

Not to mention there is a reason that those options premiums are so “sexy” and draw the amateur investor in. They are risky.

In order for the broker to entice you to risk that much money, you need a great payday. So a big payday typically comes with more risk.

To put this in perspective, let’s look at a different security. The same trades on XLP would generate about $40. But, your risk is only $6k or 82% less risk.

But, here is a true break down of what can really go wrong with high probability options trading strategies.

An often overlooked issue is you don’t know when the 10% chance in our example plays out. It could be on your very first trade and TSLA drops on bad news.

In reality there is a real possibility that TSLA can drop below your strike price quickly. And you may be assigned 100 shares or more of TSLA stock (depending on how many contracts you sold).

I realize that may say, “great, I like TSLA and wanted to own them”. I hear this a lot until they are sitting on a stock that keeps going down.

The Tesla Trap

To try and highlight what I’m trying to show you, let’s suppose you did this strategy on February 19th, 2020. TSLA at this time is trading at around $917. So, you sell your Put with a 90% probability of expiring OTM and go out 30+ days. In this case, the 27 Mar 20 $620 Put, generating $667 in credit.

On February 20th, unbeknownst to many, the stock market begins its decline to the beginning of the 2020 Bear market. At the end of that day, TSLA has dropped a bit to $899.41. You think, “Not bad and no worries. The stock will move, up and down, this is expected”.

Now, just 8 long days later, TSLA is now at $667.99. Your probabilities of expiring OTM have decreased to 54%. But, you still feel confident with those odds, so you stick it out. After all, the odds are still in your favor and TSLA hasn’t gotten to your strike price.

March 16th rolls around and TSLA is at $445.07 and your option contract has a 5.61% of expiring OTM. Worst case scenario hits and you are assigned. And you shell out $62,000 for a stock that is trading on the open market for $44,507.

That’s a 28% loss in the stock. You watch your hard earned savings in your investment account drop by 28% in just one transaction. Would you have stuck with it?

In theory, you want to tell yourself that you would have. There are many out there that will tell you that you have to stick with it and there are even some that have experienced this and have stuck with it, myself included back in 2007.

They will tell you that a Bear market always turns into a Bull market and recovers, which is true. But, you don’t know how long that will be and as you research Bear markets, you see the last one was 18 months and the average Bear market is 9.6 months. The Great Depression lasted 10 years.

However, we know for a fact that most investors don’t stick with it. Most never planned for this, so when it happens, they have no idea what to do so they get out. “Take the loss and call it a day”.

The sad truth is that the history of this day will stick with you and you may never get back in. In many cases, it will affect the way you invest going forward, and not always in a positive way.

Now, in all transparency, if you did stick with this massive loss as most will say and trusted that TSLA would eventually get back to the levels it was at, today your $62,000 investment in TSLA stock would have doubled.

The all too often reality is that most can’t weather a storm they never planned for in the first place and they often have two big hurdles to overcome. One is the massive loss of money and the second is seeing how much they could have made if they just stayed in.

For the latter group that stayed in, this is actually more detrimental to their future trading because they think they have outsmarted the market and they are invincible. This invincibility will eventually wipe them out. But, don’t take my word for it, read this book:

There is good news though. You can generate excellent returns each month using options with a fraction of the risk. I won’t cover that here as I’ve covered this in a previous article. I left a link here:

So there is an example of a high probability options strategy using Puts, but let me show you another. One that can generate the same returns, but reduces the risk of owning the stock.

A Glimpse At A Favorite Strategy

This again involves selling options, but this time we are going to sell one option and buy another for protection. The difference between the two transactions leaves a credit and this strategy is called the vertical credit spread.

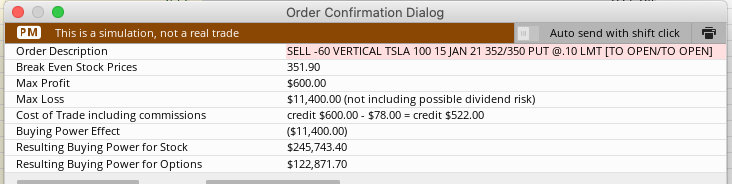

So, let’s look at TSLA again and apply the same principles. Using our numbers above, I chose a spread with the same strike of $352 with a paired $350 strike and I sold enough contracts to equal roughly the same revenue of $600. You can see this below:

As you can see, we’ve kept our income or revenue at roughly the same amount of $600, but our risk is far less at $11,400. Our probabilities are also the same at 90%. So, this spread has a 90% chance that it will expire OTM and we will keep all the credit of $600.

However, even though we’ve lowered our risk, we absolutely need to have quite a few more winning trades to offset the one losing trade that is going to happen.

I say it will happen because I’ve experienced this known fact.

High probability options trading strategies are some of the most lucrative courses or scams out in the market today. They offer you high winning trade probabilities with little to no risk. The reality is that they are highly risky.

In my 7 years of options trading experience and having traded high probability options strategies such as OTM credit spreads like the example above, you can go several months of winning trades until that 10% probability rears its ugly head.

As a matter of fact, I traded for fourteen months this way without a loss and thought I was the credit spread king until one month, four of my spreads, all with probabilities above 90% lost money due to a huge market pullback.

Thankfully, I didn’t lose any of my money, but I gave all 14 months of profits back to the market. I was fortunate to have a coach who helped me through that rough patch as getting back in the market after that dismal failure was extremely difficult.

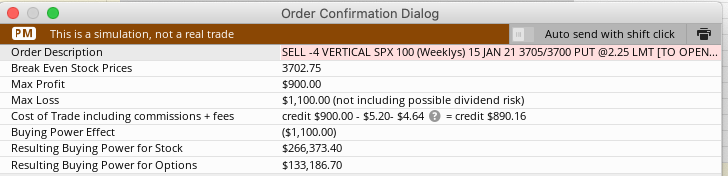

Today, I trade Low Risk/Low Probability spreads like the example below:

At the time of this snapshot, SPX is trading at $3672. I’m selling an In-The-Money (ITM) spread. The probability of this expiring OTM is about 42% but look at the risk. 90% less risk than above.

So, I can have one losing trade to two winning trades and be ahead. Because the market goes up more than it goes down, my win ration tends to be a bit better, but I also have very solid rules in place to limit my losses.

Do Not Go Out & Trade This In Real Money!

Please do not go out and try and duplicate the above example by trading your real money. You will stand a great chance of losing it as I have not shared all the secrets to this strategy here. The information presented here is for education only.

The reality is that I tend to have a lot of losing trades that I’ve exited at a 50% or even 100% loss. However, looking at this above, I only need two winning trades to get back above water to one 100% loss.

In the high probability options trading strategies with the vertical credit spread, if your very first trade on the first day of implementing the strategy was a 25% loss, you now need four winning trades to get back to break even, 5 winning trades to be above water.

If you got out at a 50% loss, which is where most finally call it quits, you would then need 9.5 winning trades to get back to break even and 10 winning trades to be above water.

Think of that based on the example above. That’s 9 months of trading to recoup your loss and 10 months to get back to break even. You would have spent the entire year and at the end, you would be right where you are at when you started.

And it gets real ugly if you have a 100% loss on your first trade. The fact is, it doesn’t matter if it’s your first trade that loses or your 31st trade that loses. With high probability options trading strategies, you need to be a superstar at winning and being able to know exactly when to get out.

So, if you are going to be allured to the following adds:

Just realize, most of these folks cannot, nor will they show you their actual trades for the year that proves this marketing tag line year after year.

This course above was recommended to me by a member of a Facebook Group I belong to. The individual was telling me how easy and predictable it was for him to generate 300% returns each month.

However, when I asked him to give me the strategies and how many years or months he’s been using the strategy as well as how many years, the author of the program revealed in all transparency their results, the conversation ended.

In the 7+ years that I’ve been learning and trading options and the myriad of courses I’ve taken and others I’ve researched, there just isn’t a get rich quick options trading course or strategy I’ve found.

As far as high probabilities options trading strategies, they are really called high probability, high risk options trading strategies. And when the risk knocks on your front door to collect, not only do you lose all that “easy” money, you lose something more important, your confidence to get back in the market.

I also did a quick video on selling put options for income that I think you’ll appreciate:

I’ll share this last point. Last night we had our final live call for 2020 with the Option Profit Formula Success Academy students. It was a special call where we asked any of the students on the call that wanted to share their results for the year, good or bad, with the rest of the group.

There was an underlying theme that ran true for just about every student that shared their stories.

The first was that they all lost money initially when trading the strategies taught. Some lost a significant portion of their accounts. But, due to being tied in with a group and having coaches that support them, they were able to turn around and get back in the game and become successful traders.

Most of them are not doubling their money week after week. As a matter of fact, I don’t think any of them doubled their accounts in the past year.

But, every single student that shared their story last night, are set to end the trading year beating the market. A few have blown away the market.

The number one reason they lost money in the beginning is because they didn’t master the number one principle we teach in the Success Academy and that’s risk management.

And that’s the number one factor that courses that teach high probability options trading strategies fail to highlight to their students.

Focus On Risk First

Focus on risk first in any strategy you decide to take on. If tomorrow you are thinking of investing $10,000 in a new, up and coming drug company at their initial public offering, weigh your risks. Do the research and look at the numbers.

It’s very easy to jump in if you’ve looked at articles that show you how much money you’d have if you invested in TSLA when it first opened. It’s a far different story when you get in at $30 and in the first few days the price drops to $10.

You must have a plan for the worst case scenario. The same holds true for high probability options trading strategies. Sure, you have a 90% probability of the option expiring OTM, but you also have a 10% probability of it expiring ITM.

What will you do if your very first trade is a 100% loss and will you be able to jump back in?

If you’ve enjoyed this article, please share it with your friends and if you are interested in learning how to trade options, check out the links below. For any questions or comments, please leave them below and James or I will get back to you.

Thanks for reading and if you haven’t done so, please subscribe. We also have YouTube channel where we share with you the things we are working on.

Leave a Reply