A Word of Caution

As I started this journey researching NIRP, I came across several different articles and information, all of which articulated one side or the other in regards to NIRP. The more research I did, the more rabbit holes I fell into.

In an effort to keep this article from veering off the road too much, I decided to give you alternative reading sources for much of that information and just stick to the main subject.

I will caution you though, you may be tempted to learn about the other subjects as it all relates to NIRP. I suggest you take it one step at a time.

What is it?

NIRP stands for Negative Interest Rate Policy. So what is that, you ask?

Simply put, NIRP is a policy Central Banks adopt to help stimulate the economy. At least that’s what they think it will do.

The idea is to charge the large institutions that park their money with the Federal reserve. This will encourage them to loan that money out to consumers, businesses and investors instead.

By doing this, they figure it will stimulate the economy by getting all that cash into the economy. Of course, charging large institutions and banks that park money at the Fed will eventually trickle down to you and I.

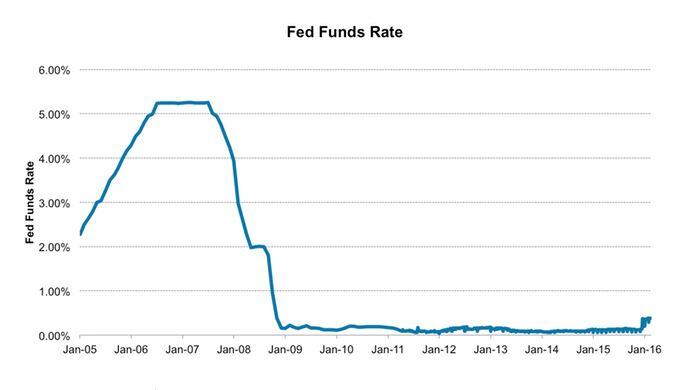

Below is a chart of the Interest rates since 2005. You can see in 2009 when rates went to zero, this was to help our ailing economy which just crashed.

But, it really hasn’t helped, so the only tool left in the Fed’s eyes is negative rates.

Other central banks have already adopted this policy. (It’s important to note that it has never been done in the United States and our economy has a greater effect on the world).

For example, Switzerland, Denmark, and Sweden have all implemented NIRP to stimulate their economies with varied results, but based on all that I have read, these economies don’t compare with ours.

All of this may sound backwards to the way our economy is supposed to work. Well, that’s what Negative Interest Rate Policies are.

This type of policy in a nut shell punishes those that save money. Money sitting in an account does nothing to stimulate the economy in the central bankers eyes.

In order for the economy to grow, there has to be consumption, and they figure this policy will drive consumption. (I believe that to be the flaw in their system because if we needed to consume more, we would).

In essence, what the central bankers are really trying to do is get you to consume today for things you won’t need until next year. Do you think that will work?

There’s Another Issue Here?

The Federal Reserve and other central banks are always trying to maintain a certain amount of inflation and they hate deflation. Deflation is bad in their eyes.

Of course that all depends on the type of deflation, money or prices. You don’t mind when gas prices go from $4 a gallon to $2, right?

It may be good for you, but it may not be good for the companies producing the gas.

A quick take on Deflation is covered in this article, Deflation, The Trouble With Falling Prices

That is a quick snapshot and my apologies if that seemed all over the place, but NIRP can’t be explained in one easy sentence. If you want to read more about it, check out this article. The Fed’s NIRP Hint

What Can We Expect?

Mass Chaos! I sure hope not, but anything is possible. It’s difficult to say what will happen if the Fed decides to lower interest rates into negative territory.

I believe most won’t even realize anything has changed.

It also depends on your situation and how the policy will affect the banks. For example, this article (NY Times) states that if you put money into a savings account, you may have less in the future, but if you had a negative interest rate mortgage, you would owe less in the future even if you pay nothing.

Right now, Jannet Yellen said they are just contemplating it, but I don’t believe that to be true. They already had large banks add negative interest rates to their annual stress tests.

So if the economy doesn’t produce positive results, that tells me it is most likely going to happen.

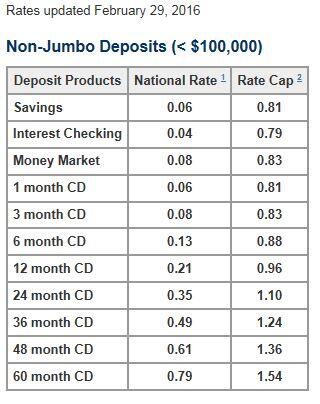

Will I be charged to keep money in the bank? It’s hard to say, but I can tell you if you think your money in a Money Market account or CD is making money now, I have bad news.

To give you an idea of how little you are making on savings, check out this chart directly from the FDIC:

So, best case scenario, if you put $10,000 away for five years, you would have a whopping $10,154.

YeeHaw, honey, pack up the house, we’re moving to Texas to buy an oil well with all that interest.

In all seriousness, these are real interest rates across the country on deposits under $100,000. The Fed likes to keep inflation around 2%, so you can see how much money you are already losing by parking it in the bank.

I also don’t believe the inflation numbers based on my own spending and where prices are today.

Caution – Rabbit Hole

Investopedia Consumer Price Index Controversy

How will it Affect Me

That is probably one of the most difficult questions to answer because we don’t know how the Fed will put out the guidance nor do we know whether banks will pass the cost onto the customer.

The whole idea behind NIRP is to stimulate growth. Quantitative Easing was supposed to do this, but it didn’t work. If it did, they wouldn’t need NIRP.

For a great article on whether it will stimulate growth, read this article. (Will Negative Interest Rates Stimulate Growth?

There are some things you can do to protect yourself against NIRP:

- Move your money into a brokerage account

- Reduce your debt

- Invest some of your cash into precious metals

- Withdraw all your cash and stuff it under the mattress

- Purchase dividend stocks of strong companies

- Continue watching the Walking Dead and pretend nothing is wrong

I have to strongly encourage you to do research for any of the options I listed. I am not a financial planner and can’t tell you what to do. What may work for me, may not be the best option for your situation.

However, I can definitely tell you that if you choose the last option, you are going to be negatively affected, but you probably won’t notice.

Before you go out and start purchasing precious metals or buying stocks, you have to do your due diligence in researching the pros and cons with each strategy.

Consult a professional. Take some financial courses.

Each one has its positives and negatives, but with precious metal investing, the goal is to preserve your wealth. Don’t look to this as you would a dividend stock.

Here are a couple of links to sites I use to research stocks and precious metals.

I also embedded a good video that explains gold and silver and how to purchase it. How to Buy Gold and Silver

I have purchased from both sites listed above and I was pleased with my experience with both.

If you look at all of this from a common sense perspective, you will see other avenues to protect yourself and preserve your wealth.

For example, if NIRP takes hold and banks do in fact start charging you fees to park your money there, where do you think folks will go?

That’s why I talked about Gold and Silver.

Commodities may actually go up in value just because of this switch. To really understand all of this, you have to first learn the difference between currency and money.

Here is where I started learning this: https://youtu.be/DyV0OfU3-FU

Not only will this help you with the effects of NIRP, but this has been very helpful for me in how I position all our wealth. I realized later in life, that one investment class (Stock Market) is not truly hedging my bets or diversifying.

For more on the different asset classes you can invest in, you should take the time to read these two books by Robert Kiyosaki:

So Where Do I Go From Here?

My mentor often tells me that education diffuses fear. If you are fearful of the future, you can’t sit around and expect anything to change. You have to become educated.

There are several ways to do this and I have given you several great places to start.

I know how difficult it can be to take the first step, but I promise, once you do you will find it wasn’t that difficult.

Today’s financial landscape has different rules than when our parents first started. If you are playing today’s game by yesterday’s rules, you are going to lose.

Most of the information I have given you is going to seem very foreign and that’s because it is how wealthy people play the game.

It’s not illegal, it’s taking advantage by using the rules to your advantage. Several folks complain that wealthy people don’t pay as much in taxes, and that’s because they play by a different set of rules.

We all have the same advantages of playing by those rules, but sadly most will never take that first step.

I can’t give you all the answers and some of the information I have given you will require and investment of time and money.

While I can’t promise you success, I can promise that doing nothing can often times be worse than doing the wrong thing. At least when you make a mistake you learn.

If my article seemed very simple, it was. I try not to get wrapped up in a lot of “smart” talk as it doesn’t help much.

Thanks for reading and please take your first step by subscribing to our blog if you haven’t already. You will receive our free book and we will never Spam you or sell your email address.

You will also receive updates whenever we post something new.

Leave a Reply